The recent headlines for Third Quarter FY24 results for Snowflake were uncharacteristically measured. Most analysts noted the fall in annual Revenue growth rates from 60% (and triple digits before that) to around 35% recently. They also hoped for better times ahead with the possibility of Fed lowering interest rates and ‘bullish commentary’ from the CEOs of the big Cloud hyperscalers.

With the excitement of the Tech/Meme ‘stonks’ era disappearing and before the AI hype gathers momentum, we have a rare moment of clarity. We can now see that Snowflake had a resilient performance in the last couple of years despite the ‘macro headwinds’.

We focus on 4 areas that surprised me in the recent quarter, given the slowdown in cloud spending in the recent couple of years.

- Gross Margin actually increases!

- Employee headcount increases!!

- Still a US-focused company

- Network effects

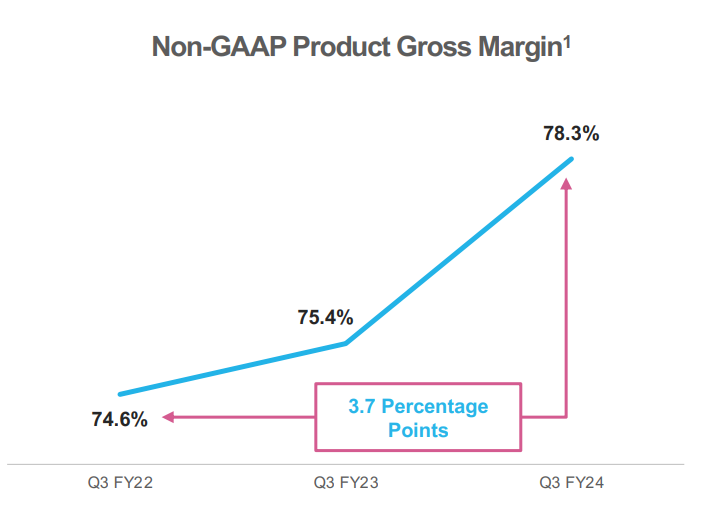

1. Gross Margin – Improves from 74% to 78%

In the Investor Presentation for Q3 FY24, Snowflake highlighted the improvement in Non-GAAP Product Gross Margin from 74.6% to 78.3% in the latest quarter.

This looks impressive considering that clients re-negotiate contracts with vendors in an uncertain economic environment. The high Gross Margin shows the pricing power of Snowflake.

Remember that Snowflake is a pioneer of the ‘Netflix’ or the ‘Pay-for-what-you-use’ model. This consumption-based model means that companies can simply dial down usage and lower their Snowflake billing quite quickly. This makes Snowflake more vulnerable than companies who have contracts with their clients.

Management attributed the improvement in margin to 4 factors:

- Cloud agreement pricing

- Product improvements

- Scale

- Enterprise customer success

AWS gets cheaper with Graviton 4?

The key seems to be be Cloud agreement pricing. Most of Snowflake is still run on AWS, around 80% according to this article from Aug 2022. So when Snowflake migrated its AWS customers completely to Graviton 4 CPUs, substantial savings were expected to be accrued. After all, Graviton is designed on an Arm-based Architecture, which is gaining ground for its energy efficiency. As the chips are designed in-house by AWS, they are considerably cheaper than equivalent EPYC (from AMD) or XEON Platinum (Intel) chips.

In the Analyst call, Snowflake CFO Michael P. Scarpelli said it’s too early to assess the impact of Graviton 4 introduction.

While the increasing Gross Margin could be driven by the Cloud providers themselves, the pricing still remains robust. The price per credit in Q3, increased by 4% year-over-year. This was attributed by Snowflake to ‘increasing consumption of higher-priced editions of Snowflake’.

How did the rest of Cloud fare in Gross Margin during an interest hike period?

Comparisons with other Cloud favorites such as MongoDB, DataDog, Twilio and Splunk shows that the increase in Gross Margin over a comparable 9-month period is good but not spectacular. DataDog and Twilio also showed similar increases in Gross Margin.

| Snow | MongoDB | DDOG | Twilio | Splunk | |

| October 31, 2023 | 68.82% | 75.27% | 81.13% | 49.95% | 80.33% |

| January 31, 2023 | 65.08% | 75.32% | 79.39% | 46.96% | 83.59% |

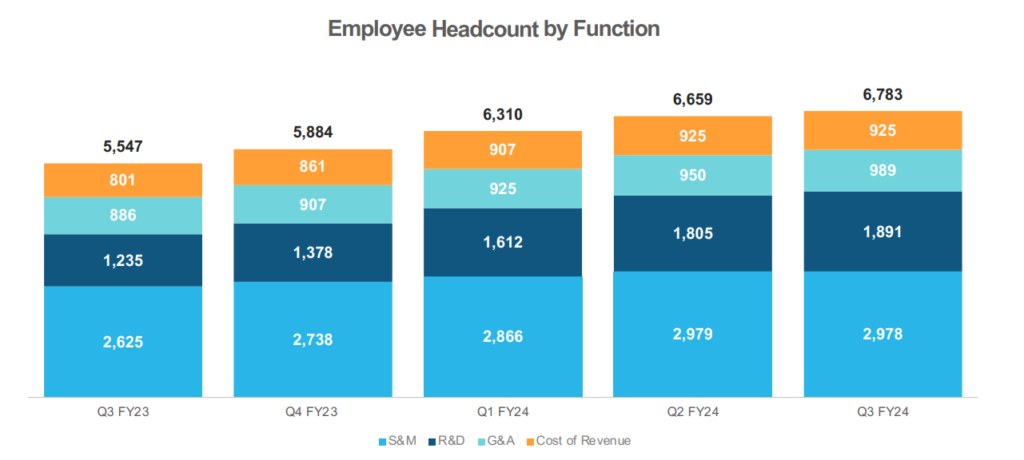

2. Employee headcount increases – amidst layoffs

In Technology companies, the main cost is usually wages/salaries or other employee-related expenses. In recessionary times, layoffs increase and new hiring is put on hold.

According to Crunchbase, the layoffs doubled in 2023.

In 2023: More than 191,017 workers in U.S.-based tech companies (or tech companies with a large U.S. workforce) have been laid off in mass job cuts, according to a Crunchbase News tally.

In 2022: More than 93,000 jobs were slashed from public and private tech companies in the U.S.

Crunchbase

Snowflake was an exception in this period when it didn’t announce any layoffs.

Over a 1-year period (Q3 FY23 to Q3 FY24), the total headcount went up by 22%. More importantly, R&D headcount went up by 53%. With the rapid advances in Gen AI, maintaining R&D lead is essential.

A part of the headcount increase was due to acquisitions or ‘Business Combinations’ as noted by Snowflake in their Quarterly Report. This included companies like Neeva, Mountain US Corporation, and LeapYear Technologies.

The focus on R&D to improve the ‘product’ is in keeping with Frank Slootman’s philosophy.

“In my experience, most sales shortfalls reflect either an inadequate product or a disconnect between the product and the target market. In other words, what you’re offering doesn’t resonate with the people you expected to like it. A strong product will generate escape velocity and find its market, even with a mediocre sales team. But even a great sales team cannot fix or compensate for product problems.”

Frank Slootman, from the book ‘Amp It Up’

While Frank’s insight into prioritizing R&D and then Sales is instructive, his other great insight is the importance of aligning the Sales incentives towards customer satisfaction rather than a finite goal like a Sale.

“[Usage-based pricing] changes your compensation plan for sales reps. You can’t pay everything on new deals. You have to pay on consumption. Every one of our reps has a big consumption quota. We fundamentally want our reps to be involved in customer success.”

Frank Slootman quote from correlated

Snowflake continues to invest in hiring people in the Sales and Marketing head count to continue its ambitious growth targets, with the focus being the ‘product’ and ‘customer experience’. This was clarified in the Analyst Call.

So first of all, in general, with sales and marketing heads, most of those typically are added right at the end of Q4 or even more so at the beginning of Q1, so people can get involved in our sales kickoff. And what I would say is we are continuing to invest very heavily in our sales and marketing function.

Michael P. Scarpelli, Chief Financial Officer, Snowflake, Inc

3. Client Concentration…but it is in the US!

We have a global financial system where companies such as Nvidia have a ‘geographical risk’ because 20% of their sales come from China. On the other hand, companies like Snowflake have 80% of their sales from the ‘Americas’.

This is seen as an opportunity to expand globally.

With the world’s deepest capital markets, the U.S. makes up 42.5% of global equity market capitalization

The $109 Trillion Global Stock Market in One Chart

There are other indications that Snowflake has room to grow and meet its ambitious target of $10 billion sales a year by 2039. The current quarter reported 647 customers who were a part of Forbes Global 2000. That still leaves 67% of the remaining companies as potential target.

The possibility that Snowflake has reached market saturation is unlikely. The more likely scenario is that the customers who opt for Snowflake’s services are the ‘early adopters’ while other companies are still migrating to the cloud (or debating migrating to the cloud).

According to Grand View Research, the Global Cloud Computing Market is estimated to be $484 billion and North America was around 35% percent in 2022. This contrasts with the 80% US ‘concentration’ for Snowflake revenues. The CFO briefly touched upon the efforts to hire people in Sales for Europe and APJ regions in the Q3 FY24 Analyst call.

In particular, in Europe, we talked about six months ago or so, we added a new leader there. We have been changing out some people and investing, and we’re continuing to and we will continue to prune underperformers globally and invest more in the right people as we go forward. And APJ is another one that we continue to invest in.

Michael P. Scarpelli, Chief Financial Officer, Snowflake, Inc

When the market for Snowflake’s services (Analytics/’Data Cloud’) matures, we can expect a greater share of its revenues from global clients. The additional customers from the rest of the world will bring down the US revenues to around 35% to 42% – in line with either the broader Cloud Market or global Market Capitalization.

Strong ‘Network Effects‘

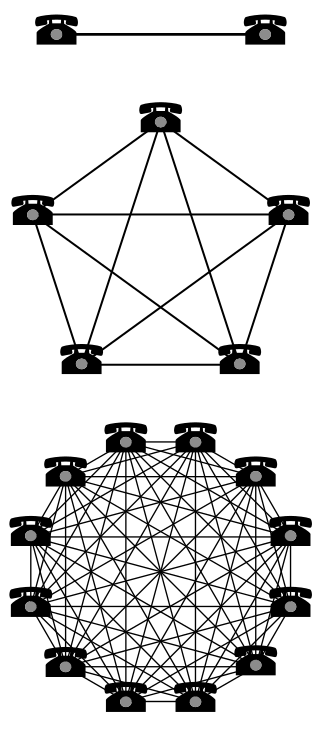

Metcalfe’s Law’s was originally applicable for Telecommunication Networks.

Metcalfe’s law states that the financial value or influence of a telecommunications network is proportional to the square of the number of connected users of the system (n2).

Wikipedia

Metcalfe’s law or Network Effects are important concepts that can help understand the value unlocked in a network by greater participation among the ‘nodes’. At some point, the gravitational pull of a strong Network Effect could lead to a ‘Tipping Point’ – where a relatively ‘stronger’ network could see runaway growth. If the growth in a) new users and/or b) interaction between nodes continues, the Network could reach the holy grail of Venture Capital investing – The ‘Winner Takes All’ effect.

That’s where Meta (Social Network) and Google (Search) are currently perched and that’s why VCs and Wall Street are so eager to fund loss-making companies/start ups. No one wants to be the person who said ‘No’ to the next Mark Zuckerberg!

4. Snowflake Marketplace

An important part of Snowflake’s evolution towards becoming a Data Cloud (from a Data Warehouse/Platform) is the launch of Snowflake Marketplace.

Snowflake defines a data marketplace/data exchange as ‘an online transactional location or store that facilitates the buying and selling of data.’

The Snowflake Marketplace ‘connects you to over 530 providers, offering more than 2,300 live, ready-to-use data, services, and Snowflake Native Apps¹ (as of October 31, 2023).’

The importance of Snowflake Marketplace is highlighted in the Snowflake Annual Report, in no less than 3 places:

- Our future success depends on our ability to continue to innovate rapidly and effectively and increase customer adoption of our platform and the Data Cloud, including

Snowflake Marketplace and Snowpark.’

- We must also continue to enhance our data sharing and marketplace capabilities so customers can share their data with internal business units, customers, and other third parties, acquire additional third-party data and data products to combine with their own data in order to gain

additional business insights, and develop and monetize applications on our platform.

- As part of our vision for the Data Cloud, we will need to grow and maintain a network of data providers, data consumers, and data application developers. The relationships we have with these partners, and that our partners have with our customers, provide our customers with enhanced value from our platform and the Data Cloud, including the Snowflake Marketplace. Our future growth will be increasingly dependent on the success of these relationships….

Snowflake Marketplace and Snowpark are important to unlock Network Effects between customers and developers respectively.

So what is the progress? There is very little evidence right now to assess the impact Snowflake Marketplace has had on the revenues, so we have to rely on broad indicators.

- Growing customer base – total customers for Snowflake in Q3 FY24 were 8907 (up 24% YOY) and Snowflake Marketplace Listings had 2332 customers (up 9% QOQ). This means that currently only 26% of the customer base is using the Marketplace.

Snowflake Marketplace was launched in June 2019 so this feature of Snowflake Data Cloud does seem to be gaining popularity quickly among the customers. - Data Sharing is rampant among the ‘big’ users – Frank Slootman elaborated during the Q3 FY24 Analyst call that “73% of our $1 million-plus customers are data sharing, up from 67% a year ago.”

If we assume that the ‘big users’ are relatively more sophisticated in terms of their data strategy, we can expect continuing embrace of Data Sharing from the rest of the customers.

Data Sharing and Stable Edges

Snowflake applies certain criteria in determining how the Data Sharing numbers above are calculated. The main criterion is the definition of ‘Stable Edges’.

We consider a customer to have engaged in data sharing if such customer had at least one stable edge as of October 31, 2023. An “edge” is a data share between a Snowflake customer and a data provider. A “stable edge” is an edge that has produced at least 20 transactions in which a providers’ data is accessed and compute resources are consumed, resulting in recognized product revenue over two successive three-week periods (with at least 20 transactions in each period).

Snowflake Analyst Presentation

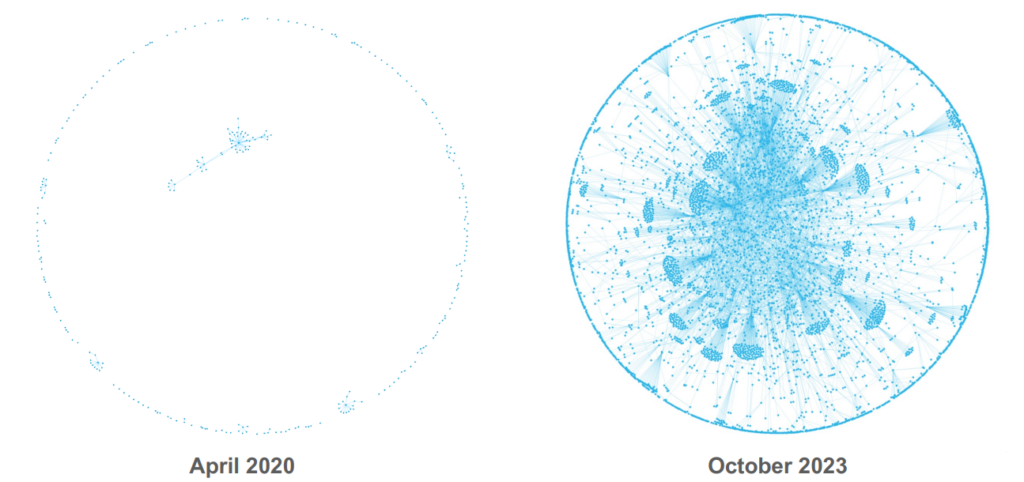

This shows that the data sharing relationships are not one-off. However, there currently doesn’t seem to be any information publicly available that shows the quantum of data sharing except for the image below in the Q3 2024 Presentation.

While the interactions between the nodes seem impressive as compared to the initial state, it tell us nothing much about the impact on Revenue or the potential for growth.

With continual additions of exciting features like Universal Search, transactions in the Marketplace should increase. (Universal Search enables customers to search the data cloud and ‘discover data and metadata that exists across their accounts and in the Snowflake Marketplace’).

We will continue to wait for further evidence that Snowflake Marketplace is catching up before we decide to get excited about the monetization of Data Products and the famed Network Effects of the Snowflake Marketplace.

Conclusion – The Heady Days are behind but more predictably fast growth still left

The days of 70% YOY revenue growth are probably over for Snowflake as its market cap has already reached $50-60 billion. This also reflects in the Price to Sales ratio, which was at an unbelievable 140 when it debuted in NASDAQ to around 20x currently – still not cheap by any means but not overvalued in a sense that stretches credulity.

In a recessionary environment, Snowflake has managed a reasonably good performance. Management guides next year’s revenue growth to be around 30% and that will be the trend going forward. The points below indicate that with the worst possibly behind, things might actually exceed management guidance next year.

- Gross Margin – An increase in Gross Margin and a 4% YOY price increase reflects Snowflake’s confidence in the continuing demand for its solutions, even when technology budgets are being cut or routed to buying GPU time in Data Centers.

- Headcount – We know that the total headcount went up by 22% in the last year and R&D headcount shot up by 53%. This is the most remarkable aspect of Snowflake’s last year’s performance.

Most Technology companies are facing a double whammy of slowing revenues leading to compulsions in cutting workforce versus investing in Artificial Intelligence (AI) capabilities, just to make sure they don’t get trampled by their competitors as everyone races to be the first to incorporate AI into their offerings.

With interest rates at an all-time high, the situation is dire for most companies as they face tough choices – cut your workforce and cede ground in AI capabilities or watch the business bleed cash and hope the economic recovery is around the corner.

Against this backdrop, Snowflake’s inherent strength in generating Free Cash Flow is demonstrated. This allows it to continue hiring in Sales and R&D functions & invest in Acquisitions to add features that leverage AI. - Snowflake Marketplace and Snowpark – Snowflake has repeatedly emphasized that Snowflake Marketplace and Snowpark are critical to its goal for being a dominant Data Cloud. While there is evidence that Snowpark is gaining popularity with the developers, the same cannot be said about Marketplace. We know that 26% of the customer base is using the Marketplace, which is impressive as Snowflake Marketplace was launched in June 2019. However, there is precious little information on the amount of revenue generated by Data Sharing or its potential. Also, other organisations including Databricks have competing products that are Open Source and its unclear which way the Data Marketplace trend will head in the future.

- 80% still in AWS and US – Approximately 80% of the clients are still US-based and using AWS. We know that Snowflake is investing in expanding its Europe and APJ footprint and there is possibly room to grow till the US sales become around 40% (based on global Market Cap) or 30-35% (based on global Cloud Market) of its client base.

AWS globally accounts for 30% Cloud Market share so there is room for Snowflake to pick up customers in other non-AWS Cloud.

As optimism returns to Cloud spending and the corporate purse strings are loosened, we can continue to see revenue growth stabilising around 25-30% in the next few years. With capital dilution slowing down and continuing buybacks, we might even see Snowflake actually make a profit within the next couple of years!