The fundamental question on Tesla is whether it is an Auto company or a Technology company.

At this point, it would be safe to say that a large part of Tesla’s valuation is from the auto sales. Let’s look at the Auto Industry globally, the growth of Electric Vehicles and Tesla’s seemingly inexorable rise to dominate the EV landscape.

Global Auto Industry – $1.9 Trillion opportunity

In 2021, the Total Motor Vehicle Production globally was 80 million. Of this, Passenger Vehicles accounted for approximately 50 million vehicles sold globally.

Total Revenues from Motor Vehicles globally in 2021 was $3.6 Trillion approximately. Revenues specific to Passenger Vehicles sales globally were around $1.9 Trillion.

2022 numbers are expected to be similar but we have an idea of the total market size where Tesla is operating currently – $1.9 Trillion.

Electric Vehicles – From 15% to 100% – but When?

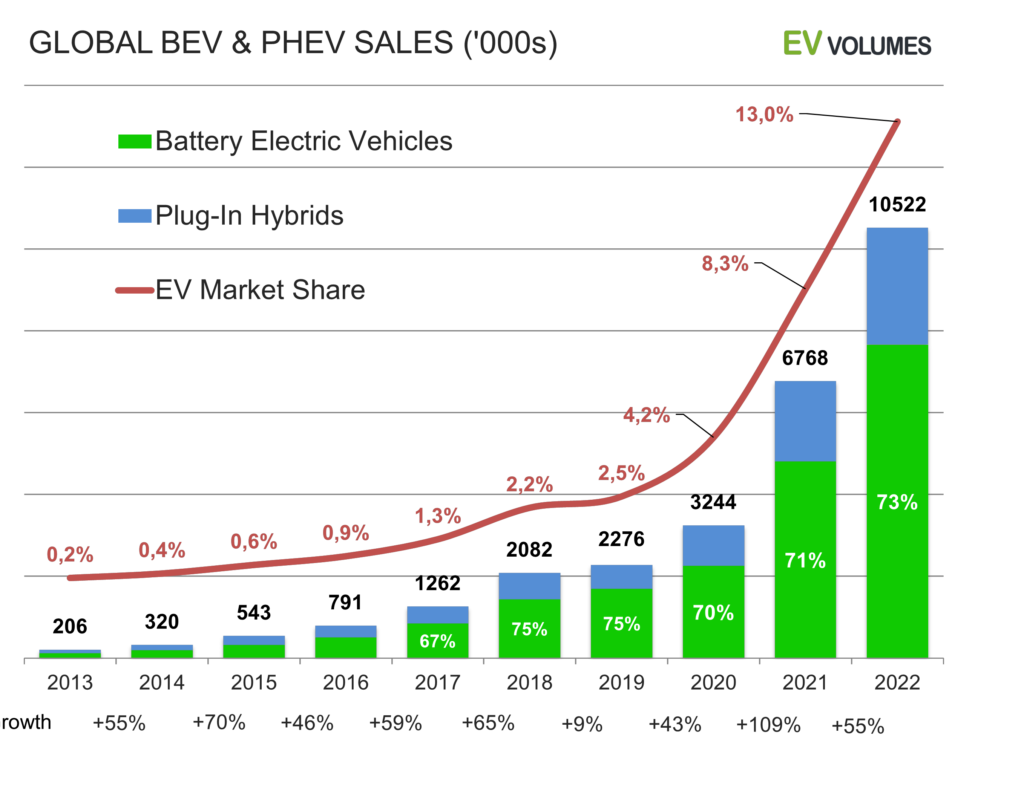

According to most estimates, Passenger Electric Vehicle sales globally are 15% of the world’s passenger vehicle sales as of Dec 2022. In 2021 global electric vehicle sales reached over 6.5 million units and the 2022 equivalent number is estimated to be around 10-11 million units.

What is astounding is the rapid rate of growth of EVs! Global Passenger Vehicle growth has been around 1% annually for the last few years with a few periods of declines interspersed – Auto is a cyclical industry after all. Globally EVs on the other hand have been growing at 50% annually for the past 10 years.

EV Growth

China driving EV Sales

A lot of this growth in EVs comes from China, which is the largest market in the world. By many estimates, China now accounts for 60% of all Global EV Sales. Already, 30% of passenger vehicle sales in China are EVs. The EV market has been growing effortlessly at 100% every year for the past few years.

China is also home to some of the most innovative and competitive EV makers. Elon Musk himself acknowledged this during the Tesla Earning Calls in Jan 2023.

We have a lot of respect for the car companies in China. They are the most competitive in the world … they work the hardest and they work the smartest … so lots of respect for the China car companies that we’re competing against.

And so, if I were to guess … probably some company out of China is the most likely to be second to Tesla

Elon Musk, Tesla Earning Calls in Jan 2023

Elon could be alluding to either Xpeng, sometimes called China’s Tesla or BYD, the company backed by Warren Buffett and Charlie Munger.

Tesla’s Revenues – Exploded off the Blocks but Settling Down

As of FY22, Tesla remains primarily an auto company with car sales accounting for 88% of revenues. The remaining 12% comes from ‘Energy generation and storage’ and ‘Services and other’. While the non-Automobile revenues are growing rapidly and have doubled in the past year, we will explore the Automobile segment for the purposes of this article.

Over the past 4 years, total vehicles sold by Tesla have grown at 52% CAGR. The revenues have grown at slightly slower pace of 40% CAGR. Regulatory Credits are around 2.5% of Revenues and not a significant contributor to Revenue growth, although they do contribute handsomely to the bottom line.

Can the Blistering Revenues continue for Tesla?

That depends on:

- EV vs ICE: How quickly do we get to a stage where BEV (Battery Electric Vehicles or EVs) replaces ICE (Internal Combustion Engine)?

- Tesla vs Rest: How fast can Tesla grow relative to a) traditional auto makers and b) other EV companies?

EVs versus ICE – Global Warming melting ICE?

The case for EVs is simple:

- Global Passenger Vehicle sales have grown around 1% for the past 4-5 years.

- EVs have been growing at 50% every year during a similar time frame

All the Top EV markets have targets to transition to sustainable vehicles. Globally EV sales account for 15% but the plan is to go 100% sustainable by 2030-2035. The following are the targets for all new vehicles to be ‘sustainable’:

- US: 100% by 2030 (2022 was 5.8%)

- China: 40% by 2030 (2021 was 16%)

- Europe: 40% by 2035 (2021 was 17%)

- Japan: 100% by 2035 (36% in 2020)

It’s interesting to note that US has the most ambitious target but is lowest in EV adoption.

All of this suggests that the EV sales should grow by 6x in 8-13 years. By conservative estimates, the EV sales should grow by at 15-25% CAGR for a decade.

Tesla versus Rest – Far ahead of the rest in the US

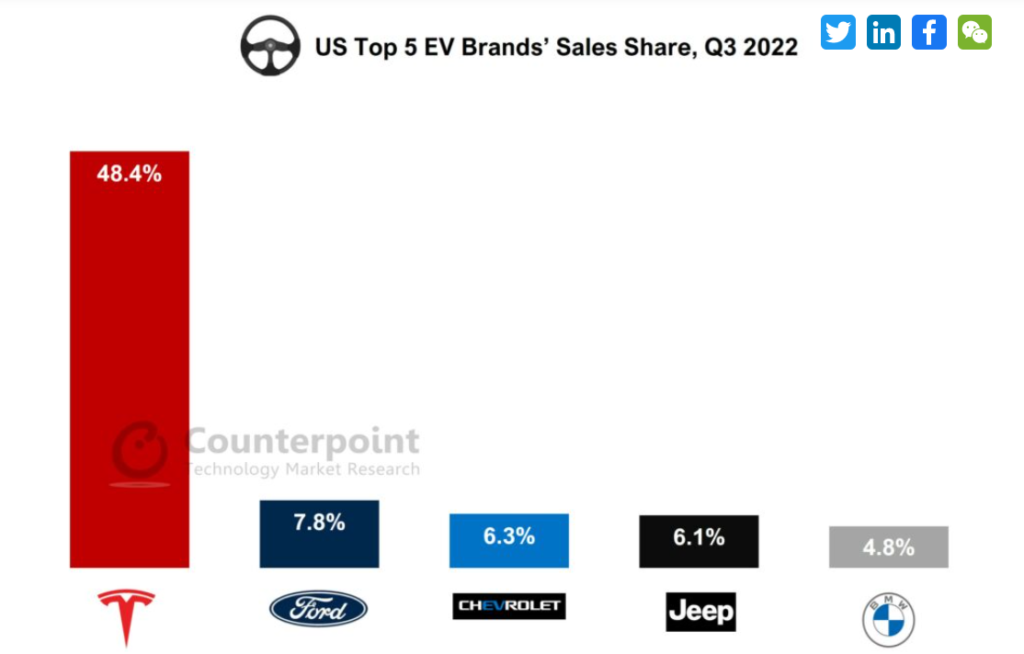

EVs account for 5.8% of all new Electric Vehicles sold in the US in 2022. Within this 5.8% space, Tesla absolutely dominates with almost a 50% share and Ford trailing at a distant second with 7.8% as of Q3, FY22 according to Counterpoint Research.

Also interesting to note is that Tesla’s total market share of new EVs sold is declining – it used to be at 80% a few years ago. This trend is inevitable in some respects as other Auto Manufacturers increase their EV sales and play catch up.

Tesla Dominating US Passenger EV Market

Can Tesla keep up the momentum in the US?

Yes, going by Customer Retention Rate surveys done by S&P Global Mobility. This is borne out by 2 simple statistics:

- ‘Nomads’ opting for Tesla: ‘Nomads’ (customers with no particular brand loyalty) account for 83% of Tesla’s car sales. This is the highest in the Industry.

- Lowest ‘One and Done’ rate: ‘One and Done’ rate is just 39% compared to 58% for the industry. This basically means that even customers with no brand loyalty (the ‘nomads’) prefer to stick with Tesla. This is also the best (or lowest) in the industry.

But does Tesla meet its match in China?

China is the world’s largest automobile market and the largest EV market for passenger vehicles. Around 16% of all new vehicles sold are EVs.

As such, China is important for any EV maker with global ambitions. Particularly for Tesla as China now accounts for around 20% of its revenues – which is half the revenues from US!

In 2021, Tesla did manage to get into top 3 EV makers in China but the established players held their turf. Given below is the share of the Top 3 EV makers in China:

- BYD – 17.5%

- Wuling – 12.9%

- Tesla – 9.4%

2022 was a year of COVID disruptions but 2023 saw Tesla making a bold move – slashing its prices in China by 6 – 13.5% on 6 Jan 2023. This resulted in immediate sales increase but it’s too early to gauge the results of the price cuts.

In short, Tesla is making commendable market share gains in China but it has tough competition in BYD and Wuling. While Tesla is a leader in Full Self Driving, BYD currently seems to be the leader in Battery Technology.

Charlie Munger had an interesting observation on why he was invested in BYD as opposed to Tesla. He said BYD was increasing prices while Tesla was cutting them – showing the inherent demand and profitability of BYD as compared to Tesla.

Conclusion

The case for Tesla rests on the inevitability of EVs.

We know that the global auto industry is around $1.9 Trillion. In Dec 2022, EVs formed 15% of this market. The pace of EV adoption has been staggering with the industry growing at 50% in the recent past.

The top automobile markets in the world (US, EU, China, Japan and India) all have targets to phase out Internal Combustion Engines (ICE) by 2030-2035. It will be safe to say that an overwhelming majority of new cars sold in 2035 will be EVs, possibly even 100%. This means a 6x growth in 8-13 years for the entire EV industry.

Within the EV space, Tesla has been ratcheting up 70% growth in its early years and has now settled down to a 40-50% volume growth in recent years. In US and Europe, Tesla absolutely dominates the market while in China, it is a strong Number 3 contender. It’s lack of presence in India is a negative, especially since India has overtaken Japan to become the 3rd largest auto market.

This does not mean there are no risks. More on that shortly.

One thing is certain – the world is moving to sustainable modes of transport and Tesla has been a major contributor towards this shift